cryptocurrency tax calculator uk

Individual crypto activities that are taxable include. Income received from bitcoin mining airdrops or DeFi rewards.

Best Bitcoin Tax Calculator In The Uk 2021

The information derived from this calculator does not constitute financial advice always speak to a tax professional to ensure it is right for your specific circumstances.

. Solana SOL Much. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins. Crypto received as salary.

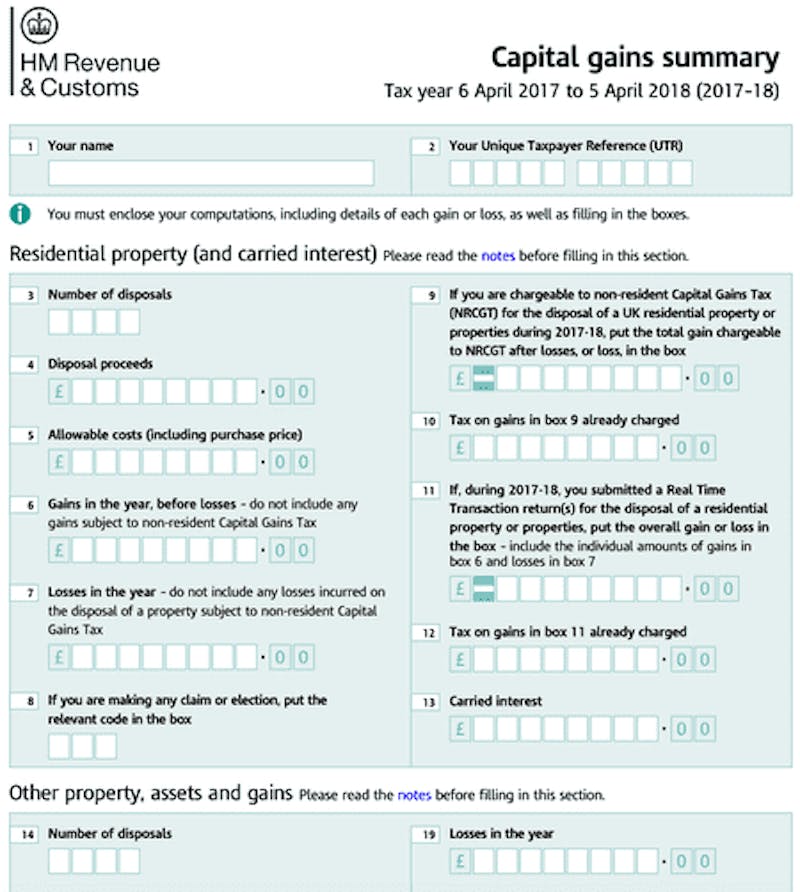

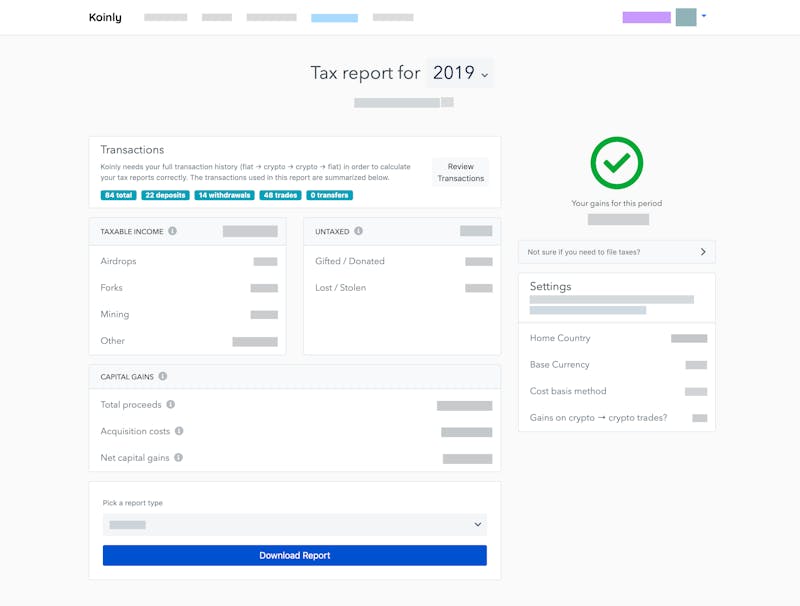

Youll then need to file and pay your Capital Gains Tax bill by 31st January each tax year. The platform is also to start using Koinlys crypto tax calculator. You only have to pay capital gains tax on overall gains above the annual exempt amount.

Finally youll need to calculate the amount youll need to pay on Capital Gains Taxes and income tax based on your tax bracket. Our platform allows you to import transactions from more than 450 exchanges and blockchains today. The Result is.

How to calculate your UK crypto tax. Why is there a crypto tax UK. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC.

Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income. How to calculate crypto taxes in the UK. We have listed down 4 of the.

Latest news and advice on cryptocurrency taxes. The original software debuted in 2014. Generate ready-to-file tax forms including tax reports for Forks Mining Staking.

Since then its developers have been creating native apps for mobile devices and other upgrades. This allowance includes crypto gains but also stock and property gains. To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions and ignore any wash sales.

All coins previously acquired. However recall that there is a broad Capital Gains Tax allowance. For individuals income tax supersedes capital gains tax and applies to profits.

Short-term capital gains are dependent on your tax bracket which ranges from 10 to 37. CryptoTaxCalculator is designed to support the unique HMRC reporting requirements including UK-specific Same Day and Bed Breakfast. Coins acquired within 30 days of the sale disposal 3 Total pool.

Youll need to separate all your transactions into capital gains transactions and income transactions. 12570 Personal Income Tax Allowance. Capital Gains Tax is a tax you pay on your profits.

The Capital Gains tax allowance for the 202021 tax year was 12300. This includes popular cryptocurrency exchanges like Coinbase Binance FTX Uniswap and Pancakeswap. HMRC also suggests what cost you can deduct from disposal proceeds to calculate capital gain.

You would only be liable for any capital gains tax above that amount. There is no exemption. Take the initial investment amount lets assume it is 1000.

CoinTrackinginfo - the most popular crypto tax calculator. UK crypto investors can pay less tax on crypto by making the most of tax breaks. Coinpanda lets British citizens calculate their capital gains with ease.

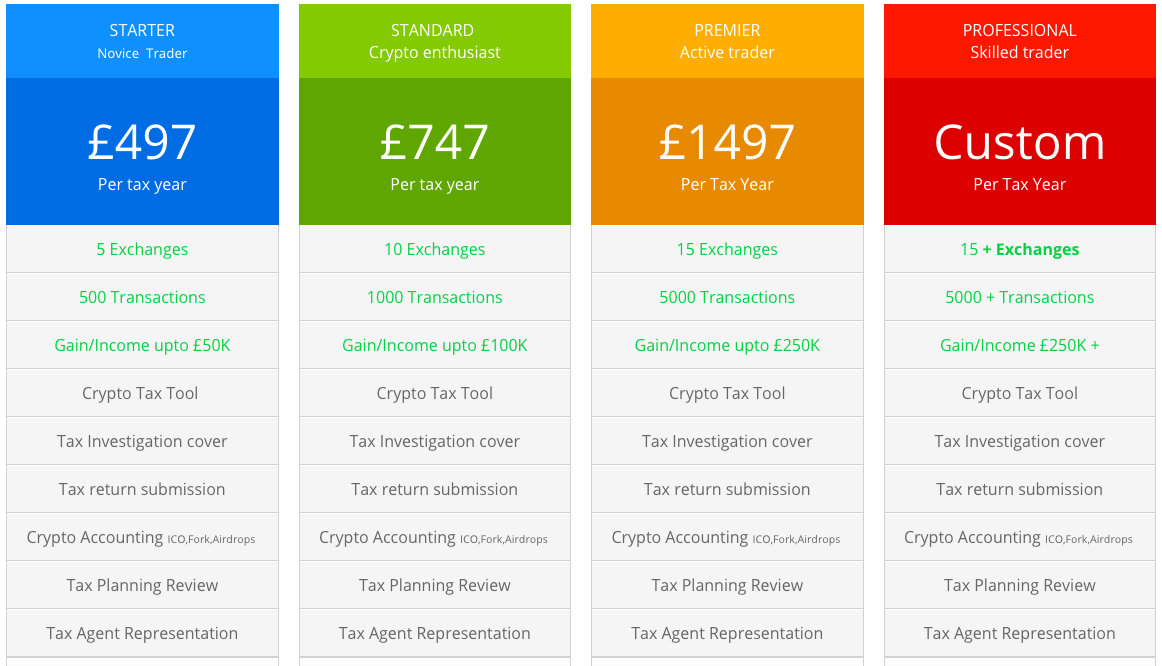

Capital gains tax report. Best Crypto Tax calculator in the UK. The Taxes Owed are.

Those who bought Bitcoin back in 2008 when it was worth fractions of a dollar could potentially have made hundreds of millions of dollars in profit in 2017 when its value peaked at almost 20000 or in 2021 when it peaked at. If your capital losses exceed your capital gains the amount of any excess loss that you can claim. Your first 12570 of income in the UK is tax free for the 20212022 tax year.

The resulting number is your cost basis 10000 1000 10. Coinpanda is the worlds most easy-to-use cryptocurrency portfolio tracker and tax software. For companies profits or losses from cryptocurrency trading are part of the trading profit rather than a chargeable gain.

Each coin was worth 1786 in June 2022 and the crypto peaked at 11578 in late 2021. Crypto tax breaks. Koinly helps UK citizens calculate their crypto capital gains.

Learn how to calculate and file your taxes if you live in the United Kingdom. Crypto tax calculator software lets the users connect or import their cryptocurrency transaction data mainly the purchase price sale price and the crypto tax calculator tool automatically provides the gains or loss and other relevant information to populate your tax reports. Enter your income for the year.

Detailed case studies tutorials. Choose how long you have owned this crypto. See the full HMRC guidance here.

Koinly is a popular platform with a crypto tax calculator available in over 20 countries including the UK. You should check with a tax professional or HMRC if you are paying the right amount of tax. It helps you calculate your capital gains using Share Pooling in accordance with HMRCs guidelines.

EToro does not represent any government entity. 10 to 37 in 2022 depending on your federal income tax bracket. The rate of CGT that you pay each year depends on the asset youve sold and how much you earn.

Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC. Heres an example of how to calculate the cost basis of your cryptocurrency. You declare anything youve earned from selling an asset over a certain threshold via a tax return.

Start for free pay only when you are ready to generate your. HMRC has published guidance for people who hold cryptoassets or cryptocurrency as they are also known explaining what taxes they may need to pay and what records they need to keep. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today.

Any gains or losses made from a crypto asset held for longer than a year incurs a tax of 0 15 or 20 depending on individual or combined marital income. At different points in the ten year history of cryptocurrency Bitcoin has fluctuated significantly in value. For 202122 the annual exempt amount is 12300.

CryptoTaxCalculator performs tax calculations with a high degree of accuracy carefully considering complex tax scenarios such as DeFi loans DEX transactions gas fees leveraged trading and staking rewards. Learn how cryptocurrencies are taxed in your country. The use of this website is not to be constitute intend or to be considered tax advice financial advice legal advice or tax.

When you spend sell or trade a cryptocurrency you need to calculate the capital gains by disposing the coins in the following order. Choose your tax status. Avalanche users can also stake their coins and receive a small reward in exchange.

To calculate your capital gains as an individual the HMRC requires you. Coins bought on the same day as the sale disposal 2 30-day rule. UK citizens have to report their capital gains from cryptocurrencies.

You can also generate an Income report that shows your income from Mining Staking Airdrops Forks etc. Then youll need to specify the buy and sell date of your assets.

Best Crypto Tax Software Top Solutions For 2022

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

Capital Gains Tax Calculator Ey Us

Calculating Crypto Taxes In Uk W Share Pooling Koinly

Top 10 Uk Exchanges To Get Crypto Tax Reports Koinly

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Uk Defi Tax On Loans Mining Staking Koinly

How To Calculate Your Uk Crypto Tax

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Uk Cryptocurrency Tax Guide Cointracker

Crypto Taxes Hmrc Eofy Tax Deadline 31st Jan 2022 Koinly

Calculate Your Crypto Taxes With Ease Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare